What is a 1099 form?

The IRS tax form 1099 is an informational form that reports income earned that has come from a source other than your employer.

If you have received income that was not from your employer, such as independent contractor or freelance work earnings, a company will report your specific earnings and payments to the IRS and you will receive a 1099 form. The 1099 is also used to report earnings and payments from other miscellaneous activities such as prizes and awards, interest, royalties, and rent received from rental properties.

Who receives a 1099?

Independent Contractors and Freelance Workers

If you are an independent contractor or freelancer, you will receive a 1099-MISC if you have received more than $600 of annual earnings from a client. The company or individual you worked for will provide you with a 1099-MISC by January 31 which you will receive either via mail or electronically. If you have received over $600 of income from multiple clients over the year, you may receive multiple 1099-MISC forms, which will be specific to each circumstance.

Individual Taxpayers

If you are an individual, you may receive a 1099-INT from a financial institution such as a bank, brokerage firm, or other business if they have paid you more than $10 of interest during the year. If you had more than $10 of funds distributed from an IRA, 401K, or another tax-deferred account, you may receive a 1099-R from the investment company responsible for your account. If you have received $10 or more in dividends or capital gains from a source such as your mutual funds or other brokerage accounts, you may receive a 1099-DIV.

Below is a list of each 1099 form, its reporting purpose, and why you may have received it.

|

Form Name |

Reports |

If You Received More Than.... |

| 1099-MISC | Miscellaneous Income | $600 |

| 1099-INT | Interest Income | $10 |

| 1099-DIV | Dividends and Distributions | $10, $600 for liquidations |

| 1099-R | Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. | $10 |

| 1099-S | Proceeds From Real Estate Transactions | $600 |

| 1099-SA | Distributions From HSA and MSA | $0 |

| 1099-C | Cancellation of Debt | $600 |

| 1099-B | Proceeds From Broker and Barter Exchanges | $0 |

| 1099-A | Acquisition or Abandonment of Secured Property | $0 |

| 1099-G | Government Payments | $10 |

| 1099-H | Health Coverage Tax Credit (HCTC) Advance Payment | $0 |

| 1099-Q | Payments From Qualified Education Programs | $0 |

| SSA-1099 | Social Security Benefit Statement | $0 |

| 1099-K | Merchant Card and Third-Party Network Payments | $20,000 |

| 1099-CAP | Changes in Corporate Control and Capital Structure | $100 mil |

| 1099-LTC | Long-Term Care and Accelerated Death Benefits | $0 |

| 1099-OID | Original Issue Discount | $10 |

| 1099-PATR | Distributions From Cooperatives | $10 |

| RRB-1099 | Railroad Retirement Board Statement | $0 |

When will I receive my 1099?

You should receive your 1099 forms by January 31, with the exception of the 1099-B which should be received by February 15.

What if I did not receive a 1099?

If you have not received a 1099 for non-employer activities, it may be that you have earned under the required amount for the year. However, this does not mean that you don’t need to report the earnings on your tax return.

If you think you should have received a 1099 form but have not, you can reach out to the specific company or individual that would have sent the form, report the form missing, or in some cases use tax form 4852 to substitute.

What do I do with a 1099?

Handling your 1099 comes with little instructions. When you receive a 1099, it will come prepared with the relevant information filled out for you such as the income earned and your personal information.

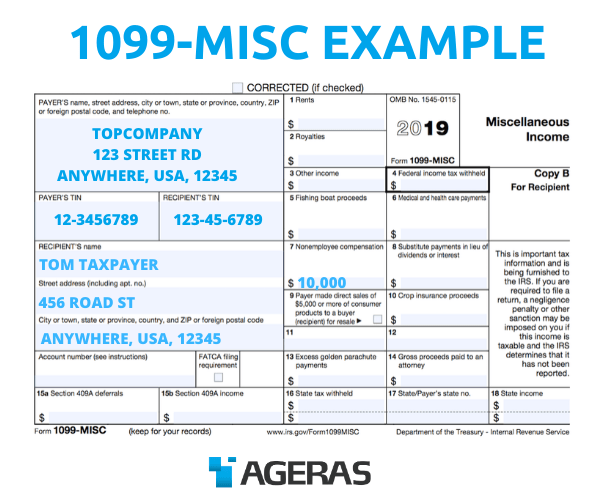

Below is an example of a 1099-MISC form:

Personal Income Taxes

When you file your personal income tax return, you will include the earnings reported on the 1099. If you are an independent contractor, freelancer, owner of a sole proprietorship, or are the sole owner of an LLC, this will mean attaching a Schedule C to your Form 1040.

Business Taxes

If you own a business that runs as a partnership, multiple-member LLC, S-CORP, or C-CORP, then you will include your 1099 with your regular business tax return.

![]() Helpful Resource: List of Tax Deadlines

Helpful Resource: List of Tax Deadlines

Form 1099 Deductions

Just because you have received a 1099 form does not necessarily mean that you owe taxes on the earnings. There are many deductions that can be applied to lower your taxable income, so it is always a good idea to touch base with a tax advisor or other financial expert to consult on the best ways to handle your tax filing and to maximize your deductions.

Do you need help with your taxes?

Finding the right accountant has never been easier. In just 5 minutes, we'll get to know you and the kind of help you're looking for.